The provider should have clear communication channels and be responsive to your queries and concerns. Regular reporting and meetings to discuss performance and improvements https://www.quickbooks-payroll.org/ should be part of their service. By doing so, businesses leverage the expertise, advanced technological tools, and refined processes of these specialized firms.

Benefits of accounting outsourcing

This can be costly and complex, especially if you don’t have legal entities in those countries. The amount of work you have available may not justify hiring one in-house, even on a part-time basis. US CPAs can eliminate operational bottlenecks & streamline workload through our quick turnaround time and 2 stage review process. https://www.kelleysbookkeeping.com/12-things-you-need-to-know-about-financial-statements/ Centaur Digital Corp, helping busy business owners efficiently manage their accounting system. You should consult with a licensed professional for advice concerning your specific situation. But financial accounting requires the utmost accuracy, and you should only outsource to expert professionals after careful planning.

Genpact: Driving Efficiency in Accounts Payable

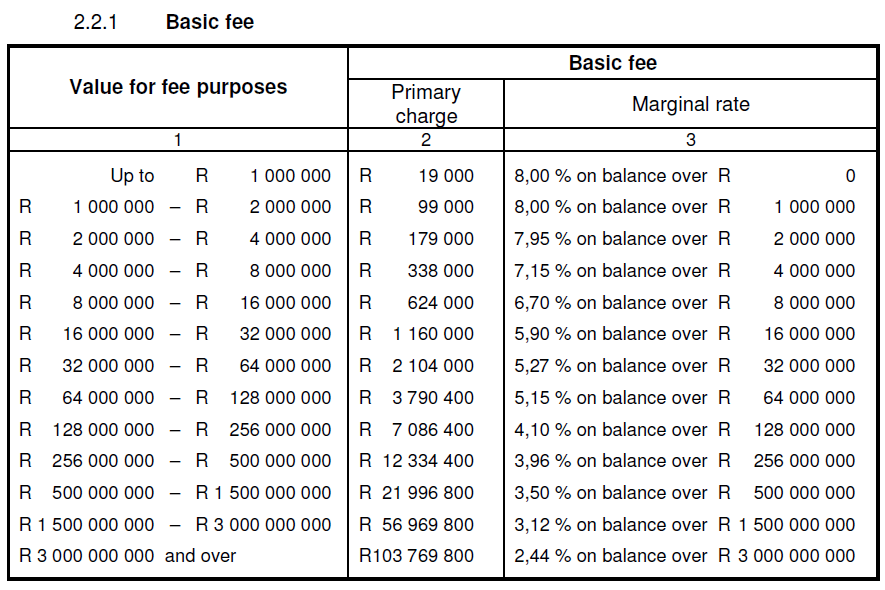

Instead of changing the system, they require more and more people to manage it—to perform data entry, to track down each approval, to catch human errors. These figures should serve as a rough guideline to estimate the range of your budget for outsourced finance services. Quality of work and quality of team members are both equally critical for those considering outsourcing their financial department.

Evaluating cost and value

Instead, give your outsourced team a decent timeline to analyze your business and understand its complexities. It’ll allow the vendor to devise customized solutions for online free ending inventory accounting calculator your needs and ensure success in the longer run. If you’re struggling to manage a complicated, manual AP process, it can be tempting to outsource your AP process.

Lower errors and better fraud mitigation

- Having a full suite of services ensures that all your AP needs are covered under one roof, simplifying management and communication.

- You may have hesitations about working with a third-party, or it may not be a reasonable choice in your industry.

- As your business changes or grows, continuously assess whether the agreement is continuing to meet your business needs.

- If they experience any issues that interrupt service for you, there’s little you can do to make sure your own vendors are still getting paid on time.

In addition to invoice receipt and data capture, ILM also offers services such as PO matching, invoice processing and routing, disbursement, accrual, general ledger, and archiving functions. By outsourcing the tasks above, your organization can focus on more strategic activities and let the outsourcing provider handle the time-consuming and tedious aspects of AP functions. Poor vendor management can lead to issues such as overpayments on invoices, missed early payment discounts, and even loss of contracts with key suppliers.

What kind of privacy or security measures does your business require (depending on the operations and data that you will share with the outsourced team)? Do you need to outsource common finance and accounting services, or do you need CFO consulting services? These are all factors that you need to consider before you even begin to look at all the financial services available.

Not all businesses are the same; thus, functions like the accounting department might not be as important in some businesses as others. Depending on your business needs, there can be advantages to outsourcing noncritical functions, including allowing you as a business owner to focus on other functions. Your company has its vision and mission for growth, which is why it’s best to work with a Finance as a Service (FaaS) provider that is willing to align with your vision and mission. The best financial service providers are keen on providing financial visibility through financial reporting.

This efficiency enables companies to capitalize on early payment discounts and avoid costly late payment penalties. One of the biggest benefits of outsourcing accounts payable processes is the potential for significant cost savings. The improved efficiency mentioned in the previous point will lead to savings in several areas, such as reduced invoice processing costs and increased vendor discounts. Outsourcing accounts payable processes can lead to significant improvements in efficiency for businesses. By leveraging the expertise and technology of a third-party provider, organizations can streamline their AP workflows and reduce the time spent on manual tasks such as data entry and invoice processing. Companies that don’t adopt the automation trend may encounter miscommunication, disorganization, slow processes, and increased staff involvement that could lead to burnout.

And with many North American organizations having established operations in the region, there is a large talent pool that is familiar with US operational requirements, schedules and pace. It’s easy to supervise your in-house invoice processing activities as your employees are always visible and accessible. There are numerous resources and teaching materials online that can provide you with a better understanding of what is needed to do the job right. This includes QuickBooks, which offers bookkeeping courses and certifications that grant business owners a solid foundation of financial knowledge to help them succeed.

Information collection, data centralization, provider selection, and implementation all require time and effort. When considering outsourcing, answer the following questions to get a better idea of your needs and what’s possible. Outsourcing accounts payable data means sharing sensitive information such as BPO and bookkeeping details with third-party teams.